For this project I chose to focus on the subject of money in the couple and this for several reasons. First of all because money can be a taboo subject, whether in a couple or in other social relationships. But also because there is a paradox between the concept of money & the concept of love. Indeed, money is a very tangible and pragmatic concept while love is an immaterial and irrational concept. This is why it is sometimes difficult to discuss money issues in a couple and why it can lead to conflicts between spouses if the subject is not addressed.

The issues of my subject

From this issue, I decided to focus my reflection more precisely on the budget management tools of couples and in particular the joint account because it is currently the most widespread solution within French couples. Indeed, according to an INSEE study "64% of the couples in the sample declared that they were organized according to the principle of total pooling, 18% according to the principle of partial pooling and 18% declared that they kept their income totally separate".

In order to better understand and identify the ins and outs of this subject, I conducted various field surveys with professionals in the field but also with a variety of users. I made a quantitative study thanks to a questionnaire that I was able to distribute to couples and also many informal discussions that I was able to have with the couples of my entourage. I also carried out a qualitative study through telephone interviews with a marriage counselor, a bank advisor, a family law attorney and video conference interviews with several couples.

Through these field investigations I was able to identify two problems in how to manage a couple's budget through a joint account:

Moit/Moit is a bank card that allows couples to make expenses together, without having a joint account. Indeed, when you pay with Moit/Moit the money is not taken from a joint account but directly from the account of each spouse.

AWith a joint account

Using Moit/Moit

The Moit/Moit service consists of two bank cards (one for each spouse) for the couple's spending and a mobile app to manage these bank cards, view the couple's spending and manage the allocation of spending between spouses.

Feature #01

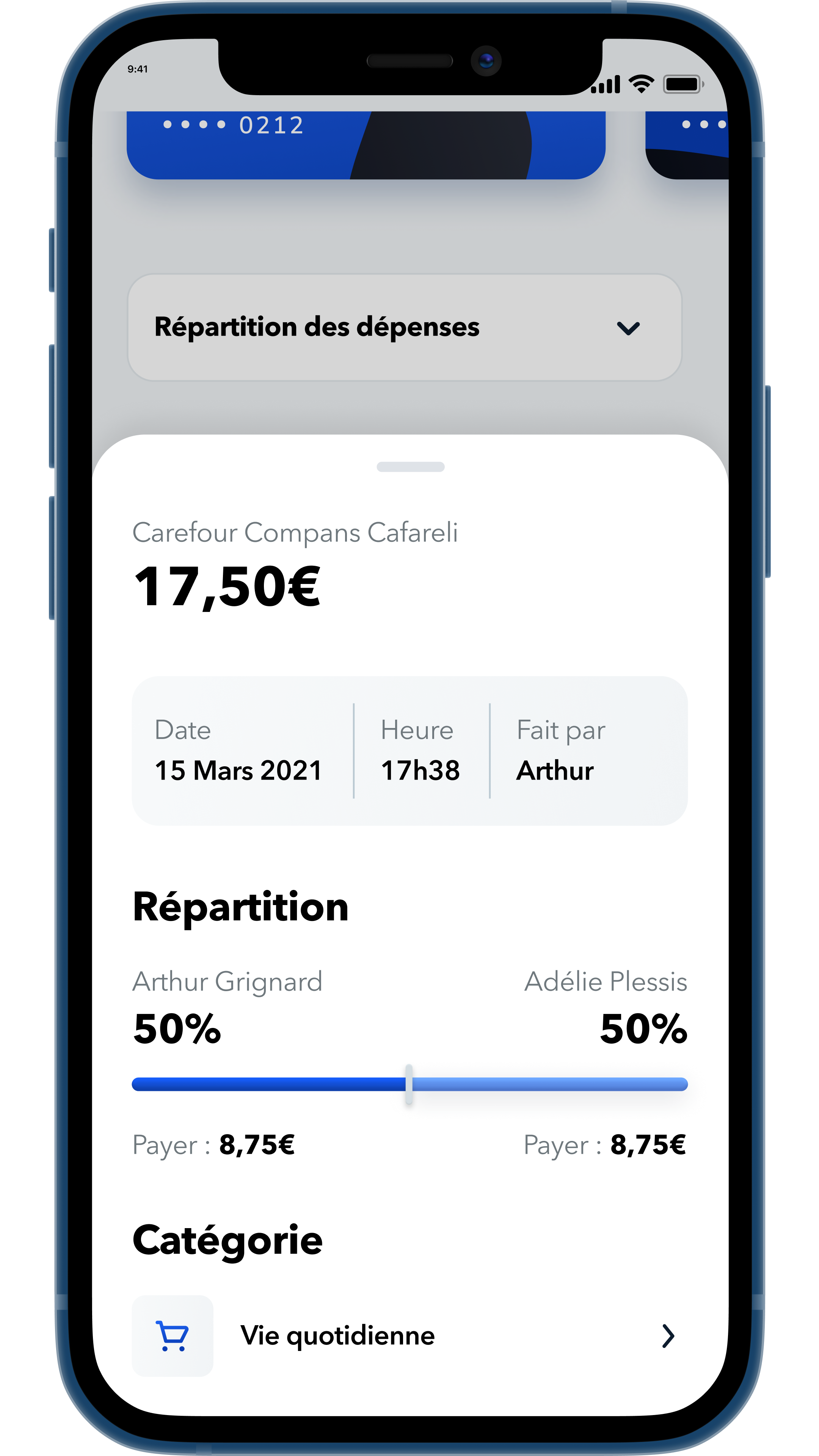

Expenses distribution

The expense allocation feature allows users to define the percentage of the expense that will be taken from their bank account. This feature is present for more equity in the couple. For example, if one of the spouses earns much less than the other, the couple will be able to define that the spouse who earns less will pay 30% of each expense and the one who earns more will pay 70% of each expense. This percentage can be changed at any time if the couple's situation changes and has an immediate effect.

Feature #02

Spending History

It is very important for users to have a history of their spending, which allows them to better visualize the couple's spending over time. Also when the user clicks on an expense he has access to more details about it and in particular about the breakdown that was applied at the time of purchase. This allows them to see exactly how much was taken from their personal account.

Feature #03

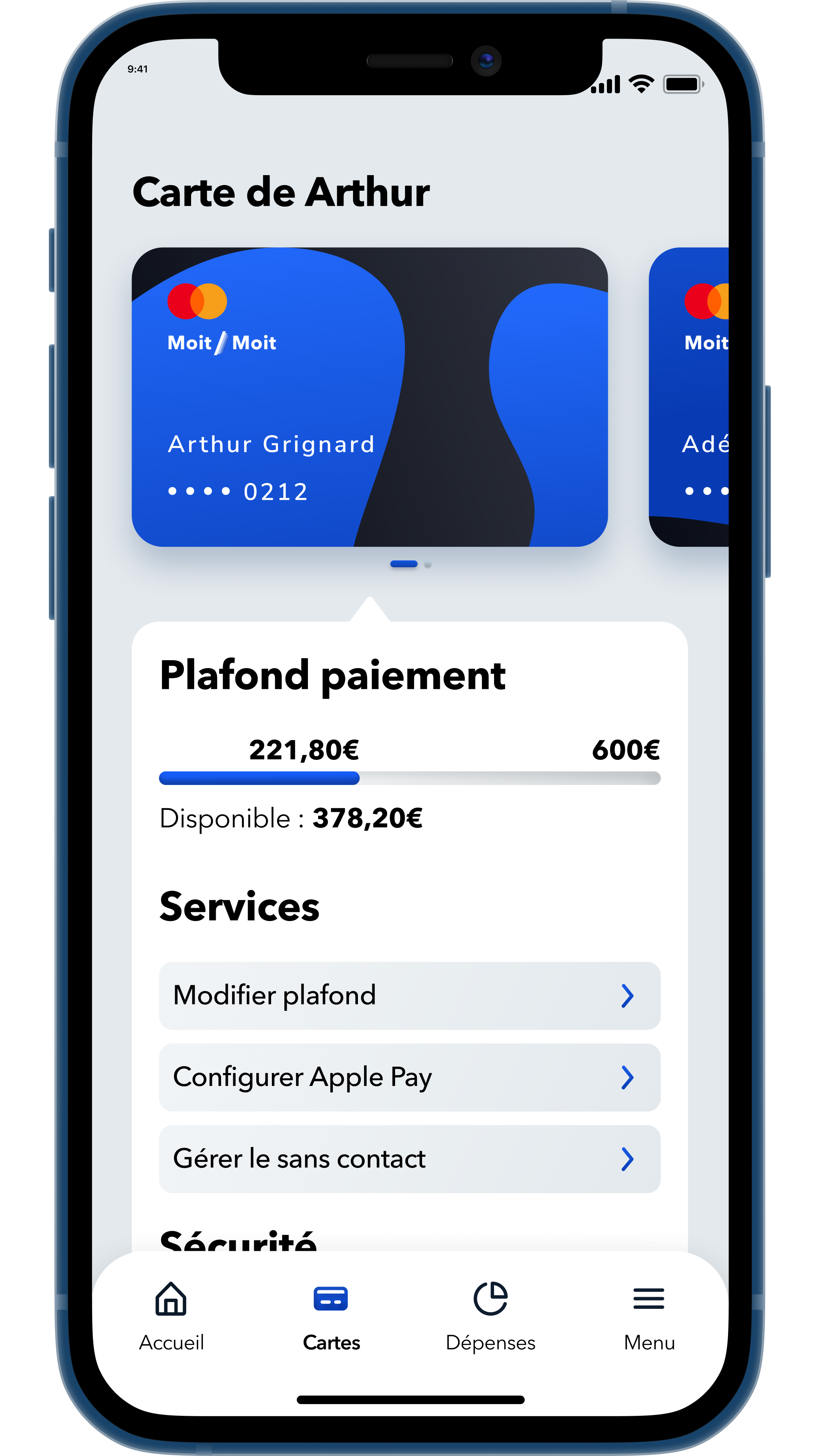

Management of bank cards

The two Moit/Moit bank cards are independent of each other and can be configured by each spouse as they wish. The user has access to classic bank card functionalities such as: modifying limits, activating or deactivating contactless, blocking the card, etc.

Feature #04

Visualize the couple's expenses

The "expenses" section of the application allows the user to view all the couple's expenses on different time scales (by weeks, months or years). The user can see how much the couple has spent over the chosen period, the distribution of expenses between each spouse and the couple's spending history.

Feature #05

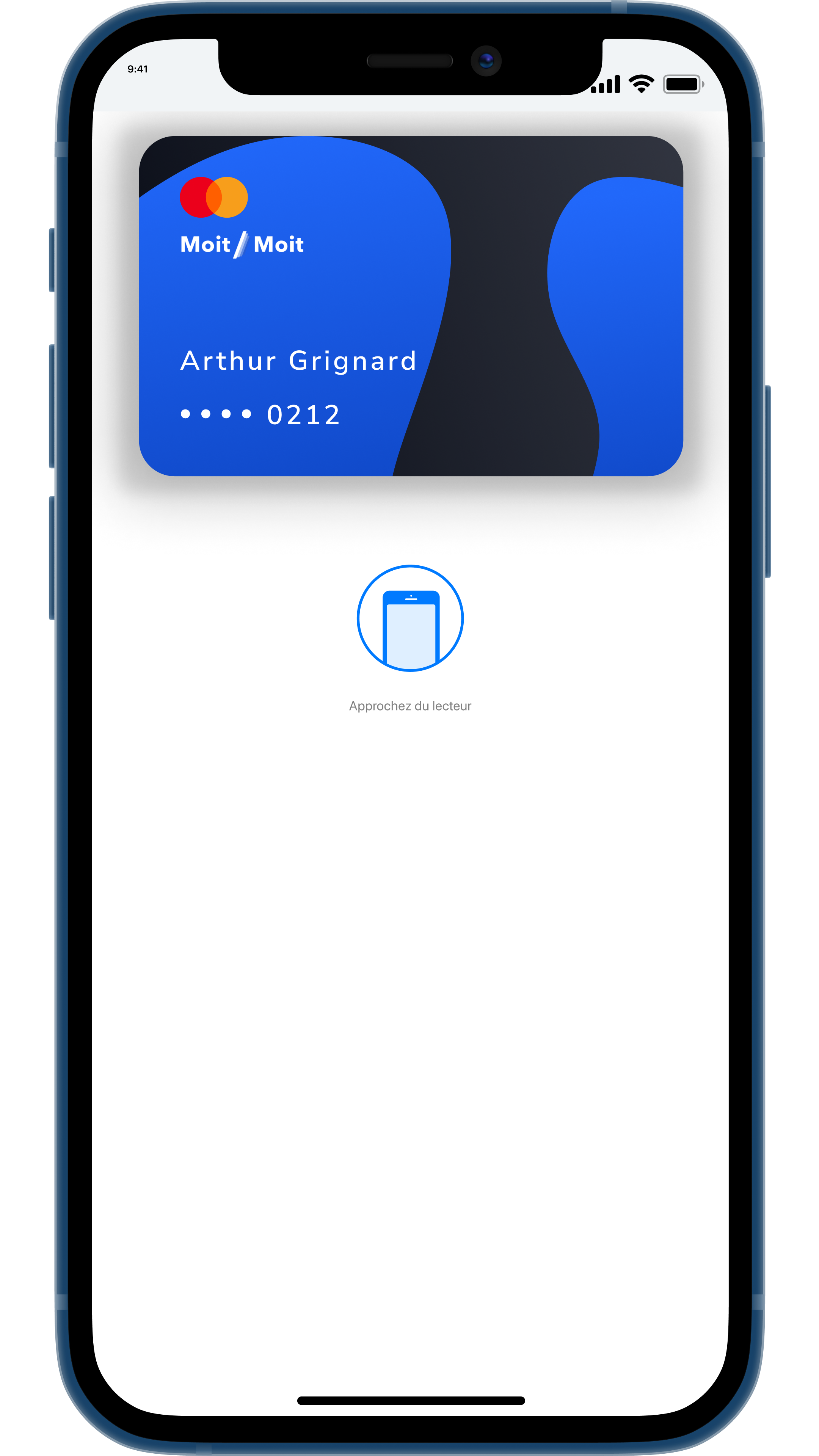

Payment Notification

Each time a purchase is made with one of the Moit/Moit cards, both spouses receive a notification on their phone that a payment has been made. This allows the user to be aware of each expense even if they are not present at the time of the purchase and it also allows each spouse to know how much will be taken from their bank account.

Feature #06

Payment limit

The payment limit feature allows the user to keep control over the expenses that can be made with the Moit/Moit card and that will be deducted from his bank account. Indeed, it is possible to define a limit amount from which the user's agreement is required to validate the transaction. This prevents one of the spouses from spending too much money without the other spouse's consent.

To set up and develop Moit/Moit, the service will be financed on a "freemium" model. That is to say, access to the service will be free and will have basic functionalities so that users can discover and test Moit/Moit. Then, if users are convinced by Moit/Moit's proposal and want to have access to more advanced features, two monthly subscriptions will be available to them according to their needs.

Subscriptions

This graduation project is the most successful project I have done during my studies. I am proud of the solution I developed and I am convinced that it meets the needs of its users. This project allowed me to really understand what is the creation of a service and all the steps to get there, whether they are part of the design domain or not.

As far as Moit/Moit is concerned today, I decided not to pursue the project because even if I am convinced of its usefulness I prefer for the moment to dedicate my skills to other projects. Indeed, I wish first to develop my professional experiences to enrich my skills and maybe afterwards to take back Moit/Moit where I left it.